Why was James Mirrlees Awarded the Nobel Prize for Economics in 1996?

James Mirrlees: The Nobel Laureate Who Pioneered Optimal Taxation Theory

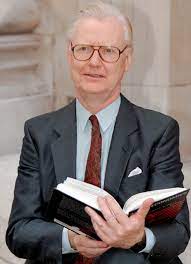

In 1996, the Nobel Prize in Economics was awarded to the distinguished British economist, Sir James Mirrlees, for his groundbreaking contributions to the field of optimal taxation theory. Mirrlees’ research revolutionized our understanding of taxation, providing critical insights into how governments can design tax systems to promote economic efficiency and social welfare.

1. Early Career and the “Mirrlees Review”

Born in Scotland in 1936, James Mirrlees pursued his academic career at prestigious institutions like the University of Edinburgh and the University of Cambridge. He made significant contributions to public finance and welfare economics, garnering attention for his work on income taxation.

In 1971, Mirrlees co-authored a seminal report known as the “Mirrlees Review,” which was commissioned by the UK government’s Economic and Social Research Council. This comprehensive study examined the structure of the UK tax system and offered valuable recommendations for its improvement. The insights from the report laid the groundwork for his later research in optimal taxation theory.

2. Optimal Taxation Theory

James Mirrlees’ most influential work lies in the area of optimal taxation theory, where he addressed the question of how governments should design tax policies to achieve economic efficiency while maintaining social equity. In 1971, his landmark paper, “An Exploration in the Theory of Optimum Income Taxation,” presented a pioneering framework for studying the optimal structure of income taxation.

Mirrlees’ research challenged conventional wisdom by demonstrating that progressive taxation (where higher-income individuals pay a higher proportion of their income in taxes) could be both economically efficient and equitable. He showed that under certain conditions, it is beneficial to tax the wealthy at higher rates to redistribute wealth and ensure a fairer society.

3. Redistributive Taxation and Tax Incidence

Another significant aspect of Mirrlees’ research was his exploration of tax incidence, which analyzes how the burden of taxes is distributed among different economic agents. His work showed that the incidence of taxes depends not only on statutory rates but also on behavioral responses to taxation. This finding has profound implications for designing tax policies that achieve the desired social objectives while minimizing distortions in economic behavior.

Mirrlees’ research also delved into the challenges of designing income tax systems in the presence of asymmetric information. He highlighted the importance of understanding individual behavior and responses to taxation when formulating tax policies.

4. Nobel Prize Recognition

The Nobel Prize in Economics, officially known as the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, is awarded to individuals who have made outstanding contributions to the field of economics. James Mirrlees’ groundbreaking work on optimal taxation theory earned him this prestigious recognition in 1996.

The Royal Swedish Academy of Sciences acknowledged Mirrlees’ significant contributions to public finance and his pioneering efforts in developing a theoretical framework for optimal income taxation. His research provided policymakers with valuable guidance on designing tax systems that promote economic efficiency and social welfare.

5. Legacy and Influence

James Mirrlees’ Nobel Prize win solidified his position as one of the leading economists of his time. His research in optimal taxation theory continues to influence economic policy discussions worldwide, shaping the way governments approach taxation and redistribution.

Mirrlees’ work has inspired further research on optimal taxation and tax incidence, contributing to the ongoing efforts to design fair and efficient tax systems. His insights have been instrumental in guiding policymakers in their endeavors to strike a balance between promoting economic growth and reducing inequality.

James Mirrlees’ Nobel Prize win in 1996 recognized his groundbreaking research in optimal taxation theory. His pioneering work challenged traditional views on income taxation and demonstrated that progressive taxation could be both economically efficient and socially equitable. Mirrlees’ legacy endures through his influential contributions to public finance and his efforts to guide policymakers in designing tax systems that promote economic welfare and social justice. His work continues to inspire economists and policymakers alike, offering valuable insights into the complex relationship between taxation, economic behavior, and societal outcomes.